Learn how to master Spread Strategies in Nifty Options using Bull Call and Bear Put Spreads. Discover low-risk, high-reward methods perfect for BTST and STBT trading styles. If you can predict short-term movements in Nifty, Spread Strategies offer an intelligent way to capture profits with limited risk.

In this guide, we explain two powerful tools — the Bull Call Spread and Bear Put Spread — perfect for BTST (Buy Today Sell Tomorrow) and STBT (Sell Today Buy Tomorrow) traders.

What are Spread Strategies in Options?

A Spread Strategy involves:

- Buying one option.

- Selling another option at a different strike price.

- Same expiry date for both options.

This reduces your cost, risk, and exposure to time decay compared to naked option buying.

Types of Spread Strategies

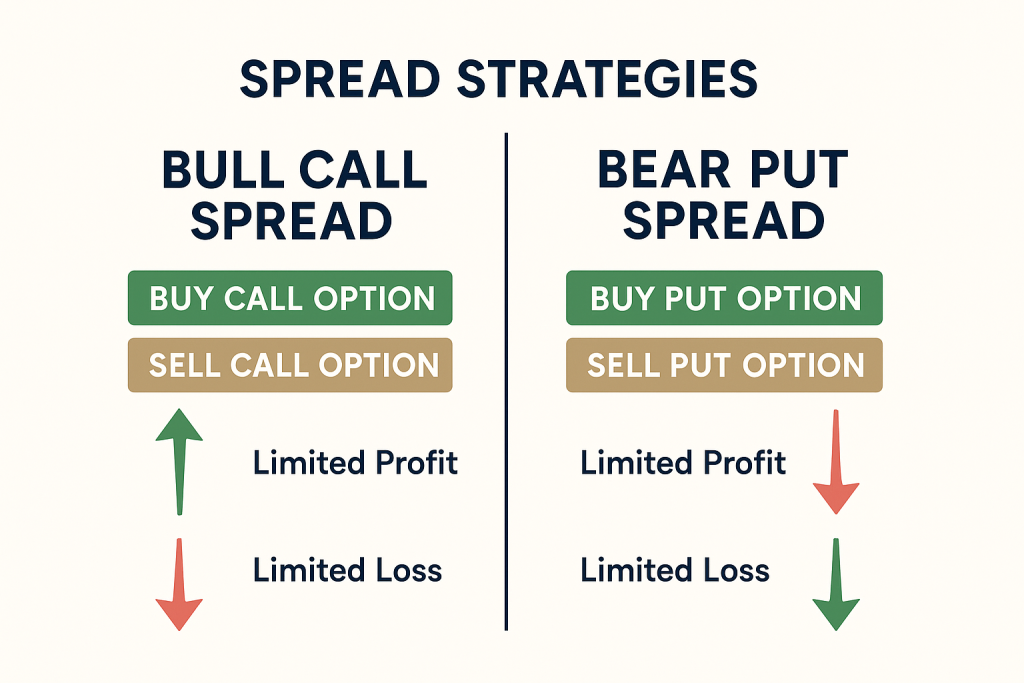

🔵 Bull Call Spread (When you expect the market to rise)

- Buy Lower Strike Call Option (e.g., 22500 CE)

- Sell Higher Strike Call Option (e.g., 22700 CE)

- Lower premium cost compared to buying a single call.

🔴 Bear Put Spread (When you expect the market to fall)

- Buy Higher Strike Put Option (e.g., 22500 PE)

- Sell Lower Strike Put Option (e.g., 22300 PE)

- Lower premium cost compared to buying a single put.

Benefits of Spread Strategies

✅ Lower Premium Outflow

✅ Fixed Maximum Loss

✅ Fixed Maximum Profit

✅ Reduced Time Decay Effect

✅ Less Emotional Stress Compared to Naked Buying

📋 Comparison Table: Bull Call Spread vs Bear Put Spread

| Feature | Bull Call Spread | Bear Put Spread |

|---|---|---|

| Market View | Bullish (Up) | Bearish (Down) |

| Buy | Lower Strike Call Option | Higher Strike Put Option |

| Sell | Higher Strike Call Option | Lower Strike Put Option |

| Risk | Limited | Limited |

| Reward | Limited | Limited |

| Time Decay Impact | Reduced | Reduced |

| Best for | Moderate Upside Moves | Moderate Downside Moves |

Example: How a Bull Call Spread Works

Suppose Nifty is at 22500.

- Buy 22500 CE @ ₹80

- Sell 22700 CE @ ₹25

- Net Premium Paid = ₹55

If Nifty rises to 22700:

- Gain = (200 points intrinsic value – ₹55 premium) = 145 points.

- Profit = ₹7,250 per lot (since 50 quantity).

If Nifty does not rise:

- Maximum Loss = ₹2,750 (net premium paid).

Example: How a Bear Put Spread Works

Suppose Nifty is at 22500.

- Buy 22500 PE @ ₹90

- Sell 22300 PE @ ₹35

- Net Premium Paid = ₹55

If Nifty falls to 22300:

- Gain = (200 points intrinsic value – ₹55 premium) = 145 points.

- Profit = ₹7,250 per lot.

If Nifty rises instead:

- Maximum Loss = ₹2,750 (net premium paid).

🚀 Why Spread Strategies are Perfect for BTST/STBT Trades

- 🔥 Faster returns within 1-2 days.

- 🔥 Controlled losses even if market moves against you.

- 🔥 No need for big movements — 100–150 point moves are enough.

- 🔥 Best for traders who predict direction but want lower risk.

Pros and Cons of Spread Strategies

👍 Pros:

- Fixed Risk, Fixed Reward

- Lower premium compared to naked options

- Reduced Theta (time decay) risk

👎 Cons:

- Limited profit even if market moves big

- Not suitable if you expect very large moves (like 300+ points)

Final Thoughts

Spread Strategies like the Bull Call Spread and Bear Put Spread are powerful weapons for smart traders who want steady, controlled profits in Nifty options.

If you predict Nifty’s direction well but want to limit your risk, using spread strategies for BTST and STBT trades is one of the best methods available.

By mastering these techniques, you can improve your win rate, reduce stress, and build a sustainable trading journey!